Nonresidential Construction Spending Bounces Up in April

For the first time since March 2009, private nonresidential construction spending increased 1.7 percent in April, according to the June 1 report by the U.S. Census Bureau. However, on a year-over-year basis, private nonresidential construction spending is down 24.6 percent.

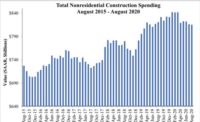

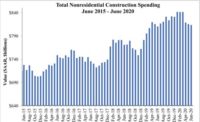

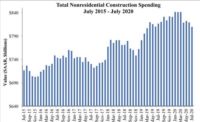

For the first time since March 2009, private nonresidential construction spending increased 1.7 percent in April, according to the June 1 report by the U.S. Census Bureau. However, on a year-over-year basis, private nonresidential construction spending is down 24.6 percent. Total nonresidential construction – which includes both private and public – is up 2 percent for the month, the second consecutive monthly increase. Since April 2009, total nonresidential construction spending is down 16.1 percent and now stands at $596.9 billion.

Twelve of 16 nonresidential subsectors posting increases in April include conservation and development, up 9.5 percent; water supply, 8 percent higher; communication, up 7.3 percent; and amusement and recreation-related construction, 6.7 higher. Three subsectors have increased since April 2009 including transportation, up 17.7 percent; conservation and development, up 10.4 percent; and highway and street, 5 percent higher.

In contrast, four construction subsectors showing spending decreases for the month were public safety, down 4.7 percent; commercial construction, 3.3 percent lower; educational, down 0.3 percent; and transportation-related construction, down 0.1 percent. Those subsectors with the largest decreases since April 2009 included lodging construction, down 59.7 percent; commercial construction, 36.8 lower; manufacturing construction, down 31.1 percent; and office construction, down 29.4 percent.

Residential construction spending was up 4.5 percent for the month and 4.6 percent higher from April 2009 levels. Public construction was up 2.4 percent for the month, but down 4.4 percent compared to April 2009. Overall, total construction spending – which includes both residential and nonresidential – was 2.7 percent higher in April 2010, making it the third consecutive monthly increase, but was down 10.5 percent compared to the same period one year ago.

Analysis

“Today's report represents a reversal of numerous trends,” said Associated Builders and Contractors Chief Economist Anirban Basu. “In recent quarters, nonresidential construction spending has been fueled by publicly-financed projects, many of them in the transportation category. However, in April, transportation-related spending was essentially flat, an indication that the impact of stimulus spending in that category may have peaked and that other nonresidential construction segments will need to expand if the overall construction industry's momentum is to continue. “On a year-over-year basis, the nonresidential segments that have expanded are all closely tied to the stimulus package passed in February of 2009. These are transportation, conservation and development and highway/street construction,” said Basu.

“The generally upbeat report also highlighted several vulnerabilities that remain. For example, conventional wisdom suggests that state and local government-financed construction will decline going forward as lower levels of government seek to shrink their collective balance sheets,” Basu said. “This is consistent with observed monthly declines in spending in the education and public safety categories. Privately-financed construction also remains generally weak, with lodging related construction down approximately 60 percent on a year-over-year basis. This indicates that the construction industry has a way to go before fully recovering to activity levels seen before the economic downturn.”

For the first time since March 2009, private nonresidential construction spending increased 1.7 percent in April, according to the June 1 report by the U.S. Census Bureau. However, on a year-over-year basis, private nonresidential construction spending is down 24.6 percent. Total nonresidential construction – which includes both private and public – is up 2 percent for the month, the second consecutive monthly increase. Since April 2009, total nonresidential construction spending is down 16.1 percent and now stands at $596.9 billion.

Twelve of 16 nonresidential subsectors posting increases in April include conservation and development, up 9.5 percent; water supply, 8 percent higher; communication, up 7.3 percent; and amusement and recreation-related construction, 6.7 higher. Three subsectors have increased since April 2009 including transportation, up 17.7 percent; conservation and development, up 10.4 percent; and highway and street, 5 percent higher.

In contrast, four construction subsectors showing spending decreases for the month were public safety, down 4.7 percent; commercial construction, 3.3 percent lower; educational, down 0.3 percent; and transportation-related construction, down 0.1 percent. Those subsectors with the largest decreases since April 2009 included lodging construction, down 59.7 percent; commercial construction, 36.8 lower; manufacturing construction, down 31.1 percent; and office construction, down 29.4 percent.

Residential construction spending was up 4.5 percent for the month and 4.6 percent higher from April 2009 levels. Public construction was up 2.4 percent for the month, but down 4.4 percent compared to April 2009. Overall, total construction spending – which includes both residential and nonresidential – was 2.7 percent higher in April 2010, making it the third consecutive monthly increase, but was down 10.5 percent compared to the same period one year ago.

Analysis

“Today's report represents a reversal of numerous trends,” said Associated Builders and Contractors Chief Economist Anirban Basu. “In recent quarters, nonresidential construction spending has been fueled by publicly-financed projects, many of them in the transportation category. However, in April, transportation-related spending was essentially flat, an indication that the impact of stimulus spending in that category may have peaked and that other nonresidential construction segments will need to expand if the overall construction industry's momentum is to continue. “On a year-over-year basis, the nonresidential segments that have expanded are all closely tied to the stimulus package passed in February of 2009. These are transportation, conservation and development and highway/street construction,” said Basu.

“The generally upbeat report also highlighted several vulnerabilities that remain. For example, conventional wisdom suggests that state and local government-financed construction will decline going forward as lower levels of government seek to shrink their collective balance sheets,” Basu said. “This is consistent with observed monthly declines in spending in the education and public safety categories. Privately-financed construction also remains generally weak, with lodging related construction down approximately 60 percent on a year-over-year basis. This indicates that the construction industry has a way to go before fully recovering to activity levels seen before the economic downturn.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!